On Wednesday, July 30, 2025, the White House said the United States will impose a 25% tariff on all goods from India beginning Friday, Aug. 1, and will add an extra import “penalty” tied to India’s purchases of Russian oil and military equipment. The administration has not yet specified the size of that additional levy; officials said those Russia‑related rates would be announced separately. The move comes as Washington rolls out a revised tariff regime across multiple countries.

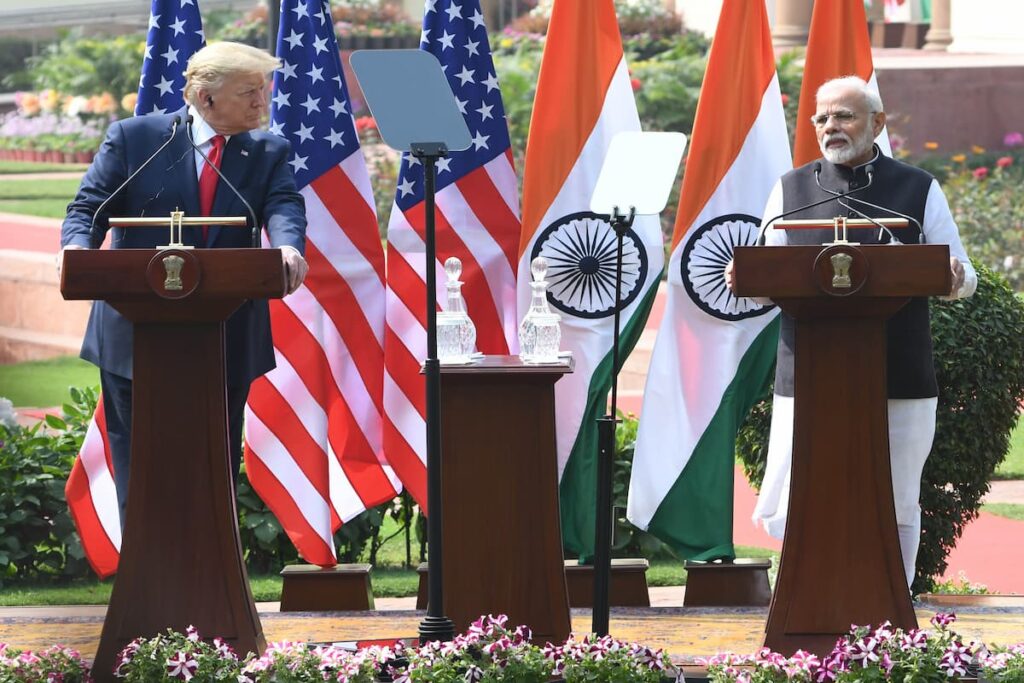

President Donald Trump framed the step as both a response to India’s “far too high” tariffs on U.S. products and a bid to curb revenues flowing to Moscow through Indian crude and defense deals. The tariff decision follows a string of trade frameworks the U.S. has reached with allies, most notably a pact with the European Union that sets a 15% baseline tariff on most EU goods entering the U.S.

Why The White House Is Acting

Officials say the administration aims to leverage tariffs to boost U.S. manufacturing and to help offset budget‑deficit increases associated with recent income‑tax cuts. Advisers have also signaled that the Russia‑linked “penalty” on India is part of a broader strategy to deter purchases that, in their view, extend the war in Ukraine. Earlier this month, the White House floated far steeper duties—up to 100%—on countries that keep buying Russian energy if no Ukraine peace deal emerges, underscoring the escalation ladder now in play.

The administration’s approach extends beyond India. By placing Europe under a 15% baseline and pursuing similar arrangements with Japan, the Philippines, and Indonesia, the U.S. is recasting market access while preserving the option to ratchet up pressure on trade partners tied to Russia. That mix of negotiated frameworks and tariff threats marks a deliberate turn toward protectionism with geopolitical aims.

Trade And Market Fallout

India is the world’s most populous country and a central U.S. partner in balancing China’s influence. But the new U.S. tariff could erode India’s price competitiveness in the American market compared with regional exporters such as Vietnam and Bangladesh, according to Indian export‑industry representatives. With the “penalty” still undefined, firms face immediate uncertainty on landed costs and pricing for fall shipments.

Trade data underscore the stakes: the United States ran a $45.8 billion goods trade deficit with India last year. New Delhi has also set an ambition to double U.S.–India trade to $500 billion by 2030, and the two sides have already held five rounds of talks toward a bilateral deal—talks that could now become more complex as Washington links tariff relief to Russia‑related purchasing behavior.

Financial markets and supply chains will be watching for sector‑specific details. An across‑the‑board 25% duty would hit everything from pharmaceutical ingredients and textiles to auto parts and IT hardware, while any add‑on penalty could further raise costs for importers. Economists caution that broad tariffs tend to lift prices for U.S. businesses and consumers, even when framed as leverage to secure concessions abroad—a dynamic already noted in analysis of the new EU 15% framework.

What To Watch Next

Two immediate milestones loom: first, implementation on Aug. 1 of the 25% India tariff; second, publication of the Russia‑related penalty schedule by the U.S. Trade Representative and the National Economic Council. New Delhi’s response—whether by seeking exemptions, adjusting oil sourcing, or signaling reciprocal measures—will shape how disruptive the policy becomes. Early international coverage, including from Deutsche Welle and Al Jazeera, highlights the geopolitical tightrope: Washington calls India a “friend,” yet is prepared to charge more because of its ties with Russia.

The tariff decision lands just days after the U.S.–EU trade framework, reinforcing a pattern: the administration is pairing negotiated baselines with targeted surcharges to influence partners’ strategic choices. Whether that combination nudges India to recalibrate oil and defense purchases—or instead prompts supply‑chain shifts away from Indian exporters—will determine the policy’s long‑run impact on U.S.–India relations, prices, and production.