Nearly 200 shipping companies, representing both private and public stakeholders, are urging global maritime authorities to approve new measures that would, for the first time, introduce a global fee on greenhouse gas emissions. The proposal comes from the Getting to Zero Coalition, a broad alliance of companies, governments, and intergovernmental organizations seeking to accelerate the industry’s decarbonization.

Industry Pushes For Regulatory Change

The coalition is pressing members of the International Maritime Organization (IMO) to adopt binding rules that will apply to all large vessels operating worldwide. Their recommendations include a mandatory emissions fee and stricter fuel performance standards. These measures are expected to be discussed in detail when IMO delegates convene in London in mid-October 2025.

According to Jesse Fahnestock, who leads decarbonization work at the Global Maritime Forum, the fact that so many companies have signed on to the appeal demonstrates strong alignment between industry players and climate objectives. “It is significant that businesses themselves are calling for enforceable regulation,” he noted, emphasizing the need for predictability to unlock large-scale investments in green fuels and vessels.

U.S. Opposition And Political Resistance

The strongest resistance is coming from the United States, where officials continue to reject the proposal. Representatives from the departments of foreign affairs, commerce, energy, and transportation have argued that the initiative amounts to a global carbon tax imposed without the consent of American voters. This stance reflects long-standing skepticism about international environmental regulations, especially under the influence of former President Donald Trump’s policies.

Despite this opposition, the April 2025 agreement within the IMO received broad international backing. The plan outlined a framework that would introduce minimum emissions fees above defined thresholds and gradually phase in fuel standards. It would apply to ships exceeding 5,000 gross tonnage, which account for roughly 85% of the sector’s greenhouse gas emissions.

The dispute highlights a widening gap between countries favoring global climate action and those prioritizing national economic interests. U.S. officials have also voiced concerns that the rules could advantage competitors like China, which is investing heavily in clean fuel production and alternative propulsion technologies.

Growing Emissions And Global Targets

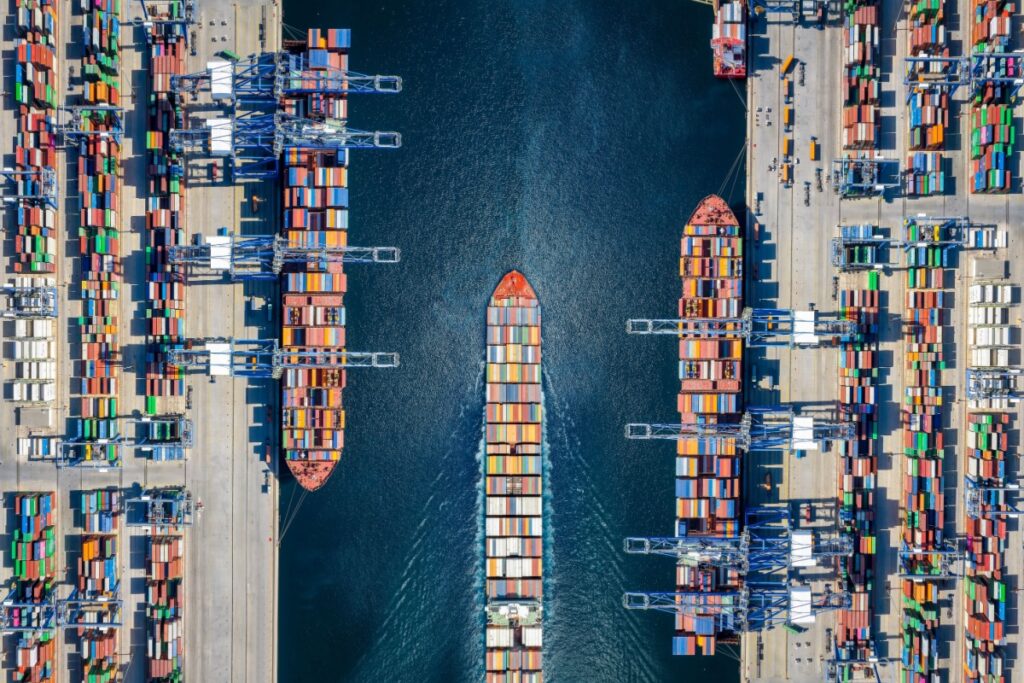

The shipping sector currently generates about 3% of worldwide greenhouse gas emissions, a share that has steadily increased over the past decade due to growing global trade. Without decisive measures, analysts warn, emissions from shipping could rise significantly by 2050, undermining international climate agreements.

In response, the IMO has set a target of achieving net-zero emissions around 2050, with an interim objective of ensuring that at least 5% to 10% of energy used by shipping comes from zero- or near zero-emission fuels by 2030. The April 2025 regulatory package laid the groundwork by combining emissions fees with technical standards for fuels. If approved in October, the new system could come into effect in 2027, giving shipping companies time to adapt their fleets and fueling infrastructure.

The package has been described by climate experts as one of the most ambitious attempts to regulate a hard-to-abate sector. Given that the majority of international shipping operates across multiple jurisdictions, only globally enforced rules through the IMO are seen as capable of delivering meaningful reductions.

Implications For Clean Shipping Transition

For shipping companies, the adoption of binding measures is seen as a critical step toward ensuring long-term business certainty. Organizations like the International Chamber of Shipping, which represents over 80% of the world’s merchant fleet, argue that regulatory clarity will allow firms to invest in cleaner technologies without the risk of being undercut by competitors using cheaper, higher-emission fuels.

Industry leaders stress that innovation is already underway, with projects exploring green hydrogen, ammonia, and methanol as alternatives to conventional marine fuels. However, scaling these solutions requires significant financial commitment, which many investors will only make if they know future emissions costs are predictable and globally enforced.

If the IMO fails to reach consensus, environmental groups warn that the industry risks delaying its decarbonization, making it harder to meet global climate goals. At the same time, failure could trigger a patchwork of regional rules, with the European Union and other blocs potentially imposing unilateral carbon pricing systems on international shipping.

The stakes are high: with global trade projected to expand in the coming decades, shipping’s role in climate change will grow unless systemic reforms are implemented. The outcome of the October IMO meeting is expected to signal whether the sector will move collectively toward decarbonization or continue to face fragmented approaches shaped by competing national interests.