Thanks to the AI Boom, early investors in Big Tech stocks like Nvidia (NVDA) became millionaires overnight.

While growth will still occur, the likelihood for a similarly massive short term upside in those stocks has passed. As keen investors look for the next big win, a new investment opportunity has emerged in AI’s biggest challenge: Power.

To satisfy the skyrocketing energy demand from AI-powering data centers, companies like Amazon (AMZN), Google (GOOGL), Meta (META), and Microsoft (MSFT) have been quietly investing billions into nuclear power in the form of energy deals and nuclear real estate. With sustainability commitments in place, these tech companies cannot afford to regress into high-carbon energy sources to power their AI.

But why nuclear, and why now? And most importantly: How can the everyday investor profit massively from this?

The answer lies in nuclear power’s main fuel: Uranium. And the biggest upside opportunity lies in the companies that mine it. The most significant gains will come to early investors in undervalued uranium companies that operates in Canada’s Athabasca Basin, the world’s highest-grade uranium region.

But in order to understand why investors can expect the highest returns from junior uranium stocks like, it is important to contextualize the uranium market, as well as the AI and energy megatrends driving its growth.

Why Tech Giants Are Investing Billions Into Nuclear Power Over Other Renewables

Hyperscale data centers are the backbone of AI and cloud computing, but they are also incredibly power-hungry.

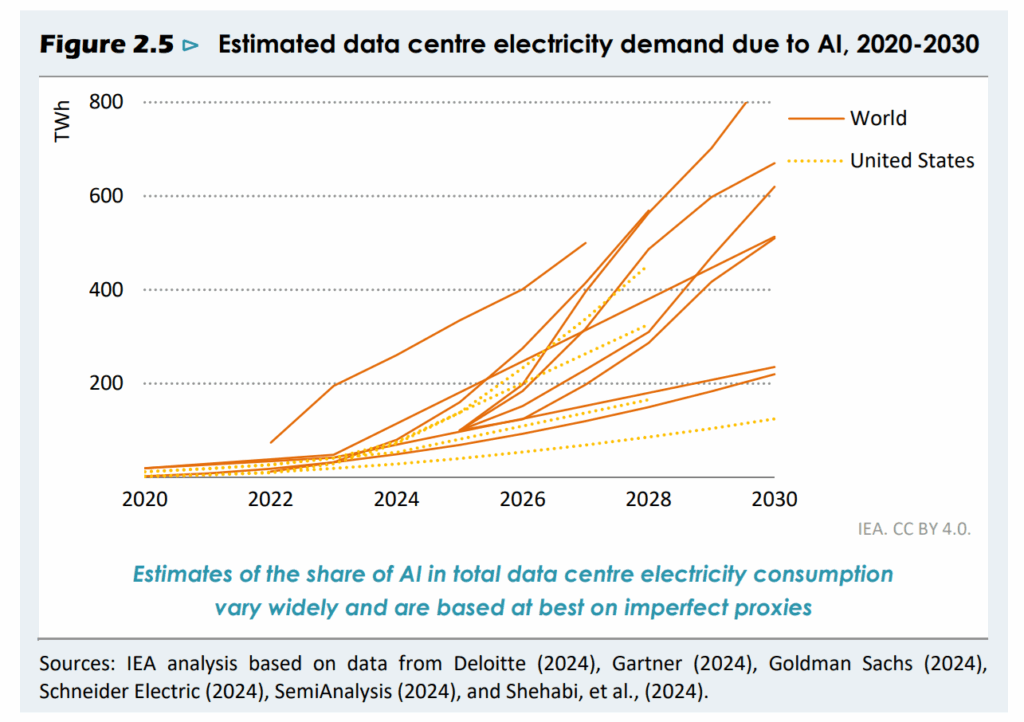

Data centers consumed about 1.5% of the world’s electricity in 2024, and this consumption has been increasing by 12% annually over the last five years. The International Energy Agency (IEA) anticipates that by 2030, electricity consumption by data centers will be higher than the entire electricity consumption of Japan today.

Rising energy demand from data centers is also projected to increase CO2 emissions from 180 million tonnes to 300 million tonnes by 2035 without cleaner energy. This trend is unsustainable for tech companies like Microsoft and Amazon, who face growing stakeholder pressure to uphold their innovation and net-zero goals.

Big Tech is a high stakes industry where innovation drives growth and sustainability shapes public perception. This means tech companies are at a crossroads:

- Renewables are insufficient: Wind and solar, while important, their inconsistent electricity production necessitates extensive and costly battery storage solutions to compensate for periods of low wind or sunlight.

- Fossil fuels are not an option: Given their ambitious net-zero targets, companies such as Microsoft and Amazon cannot risk reverting to high-carbon energy sources.

- Nuclear offers 24/7 clean energy: Unlike renewable sources, nuclear power offers consistent, zero-carbon electricity, making it an ideal baseload for the global electric grid as data center energy demand skyrockets.

Microsoft recently signed deals to source power from nuclear reactors, including a 20-year, multi-billion nuclear power agreement with Constellation Energy (CEG). Meanwhile, OpenAI’s Sam Altman continues to invest heavily in Oklo Inc. (OKLO), a modular nuclear reactor startup.

This trend isn’t new. Last year, Meta put out a call for nuclear proposals, Google agreed to buy new nuclear reactors from Kairos Power, and Amazon partnered with Energy Northwest and Dominion Energy to develop nuclear energy, with plans to invest $500 million in several small modular reactor projects, including a large equity investment in developer X-energy .

While the case for nuclear energy companies as an investment may seem evident, there are not many public reactor companies yet, and those that do have premium pricing. Until more companies go public or prices become more affordable, investors looking for the biggest upside can massively profit from nuclear energy today through uranium stocks.

How To Profit The Most From Uranium’s Bull Run

As uranium demand grows due to increased reactor count, a decade of underinvestment in uranium mining has created a supply shortfall for the commodity. The projected 40-million-pound annual deficit by 2030 represents approximately 20% of current global uranium demand.

This projected shortfall supports higher spot prices for a long-term bull run. Recently, uranium markets experienced a strong resurgence in May, largely due to a significant acceleration in U.S. nuclear energy policy and renewed industry confidence. Although year-to-date performance has been modest, uranium spot prices are still at a multi-decade high.

This recent rally highlights the commodity’s ability to reprice quickly when market sentiment aligns with its consistently strong fundamentals.

Due to rising uranium demand and tightening supply chains, investors should start looking beyond established mining corporations for greater upside in stocks from emerging competitors.

Disclaimer: The Publisher Network Aigency inc., along with its staff and affiliated marketing partners, does not hold shares, options, or any other derivative interests in the companies referenced in this publication, and has no current intention of acquiring such interests. Historical performance is not a predictor of future outcomes. The information presented should not be viewed as a suggestion or endorsement of any specific investment, transaction, portfolio, or strategy for any individual investor. This article was created and researched using artificial intelligence, using publicly available information.The author is not offering personalized financial guidance, nor evaluating the characteristics, risks, or suitability of any security or investment decision for your situation.

You are solely responsible for assessing whether any investment, product, service, or strategy aligns with your financial goals and personal situation. Any opinions or statements included here may not represent the views of The Publisher Network Aigency inc. in their entirety. The Publisher Network Aigency inc. is not registered as a securities dealer, broker, licensed investment adviser in the United States, or investment bank.

This content is sponsored material and should not be interpreted as an endorsement to buy or sell any securities. The Publisher Network Aigency inc. has a marketing partnership with CIBIDI CORP., which has arranged and funded the sponsorship of this article on behalf of Kirkstone Metals Corp. CIBIDI CORP. receives financial compensation from Kirkstone Metals Corp. for promotional and marketing support.