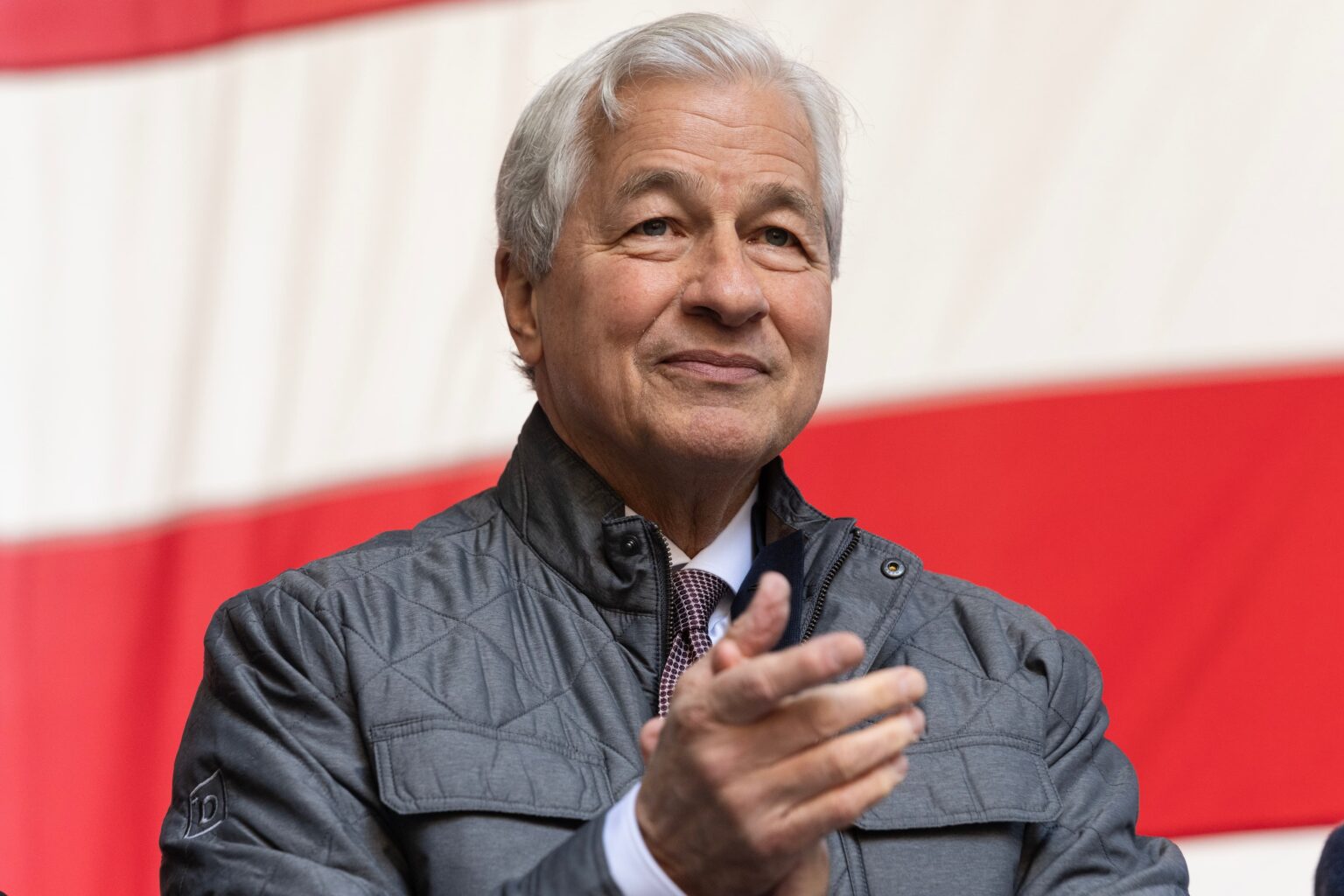

Jamie Dimon, CEO of JPMorgan Chase, issued a strong defense of the Federal Reserve’s independence during a conference call on July 15, stating that safeguarding the central bank’s autonomy is “absolutely critical.” His remarks come amid growing concerns that President Donald Trump may interfere with Fed policy or leadership as he pushes for faster interest rate cuts ahead of the 2026 midterm elections.

Dimon emphasized that protecting the Fed from political influence is essential for preserving U.S. economic credibility. He warned that attempts to influence or undermine the institution could backfire. “Playing around with the Fed can often have adverse consequences, absolutely opposite of what you might be hoping for,” he said.

Without naming Trump directly, Dimon clearly addressed the current administration’s public and private pressure on Fed Chair Jerome Powell, whose stance on maintaining stable rates has at times clashed with the White House’s push for aggressive monetary easing. Dimon stressed that Fed independence must be upheld regardless of who occupies the Oval Office.

Rising Tensions Between White House and Fed

President Trump, who reappointed Powell as Fed Chair in 2022 before publicly turning against him, has increasingly expressed frustration with the central bank. He has pushed for faster and deeper rate cuts to stimulate the economy and boost lending—moves some economists warn could fuel inflation or destabilize long-term expectations if not based on sound data.

Dimon, speaking as JPMorgan reported second-quarter results, took the unusual step of directly addressing the issue. “This is not about any one person,” he said. “It’s about institutional integrity. You need to trust that monetary policy is being guided by long-term economic principles—not political cycles.”

Trump has not ruled out removing Powell or influencing future appointments at the central bank to ensure policies more aligned with his agenda. Several reports from Washington indicate that the administration has evaluated legal pathways to exert more control over the Fed, including exploring legislative proposals to increase White House oversight of interest rate decisions.

Fed officials, for their part, have remained measured. Powell continues to emphasize data-dependent policy decisions and has so far declined to respond directly to Trump’s criticism. His approach has been praised by financial markets for maintaining stability during a politically turbulent time.

The situation is being closely watched by global financial institutions. European Central Bank President Christine Lagarde and several G7 finance ministers have privately expressed concern about any erosion of central bank independence in the United States, viewing it as a potential trigger for market volatility worldwide.

Wall Street Reacts as Rate Debate Intensifies

Markets responded cautiously to Dimon’s remarks, with bond yields holding steady and equity markets showing little immediate reaction. However, analysts noted that Dimon’s unusually candid warning may signal growing unease within the financial sector. While few expect drastic Fed leadership changes in the near term, the specter of political interference could affect investor confidence if it continues to escalate.

Dimon’s comments came as JPMorgan reported robust earnings, supported by strong performance in trading and investment banking. While net income fell 17% from the same quarter a year ago, the results beat Wall Street expectations and helped lift bank stocks across the board. Citigroup and Wells Fargo also reported solid numbers, citing increased dealmaking activity and improved credit conditions.

Still, risks remain. Dimon cited growing economic vulnerabilities, including persistent deficits, geopolitical instability, and uncertainty surrounding global trade. He argued that undermining the Fed’s credibility at such a moment would be short-sighted and could raise long-term borrowing costs rather than lower them.

Several top financial executives reportedly share Dimon’s concerns and are considering issuing a joint statement in defense of the central bank’s independence if tensions continue to rise. So far, Dimon is the most prominent Wall Street figure to speak out publicly.

His intervention marks a significant moment in the ongoing debate over the future of U.S. monetary policy—and whether it can remain shielded from the partisan pressures of Washington under President Trump’s leadership.