Japan has reported a global trade deficit of 5.2 trillion yen (approximately $37 billion) for the fiscal year ending in March, according to data released by the Ministry of Finance. This marks the fourth consecutive year that Japan has run a trade deficit, signaling continued strain on its external balance. The deficit has been largely driven by a rise in import costs, especially for fuel, food, and industrial raw materials, made more expensive by the depreciation of the Japanese yen.

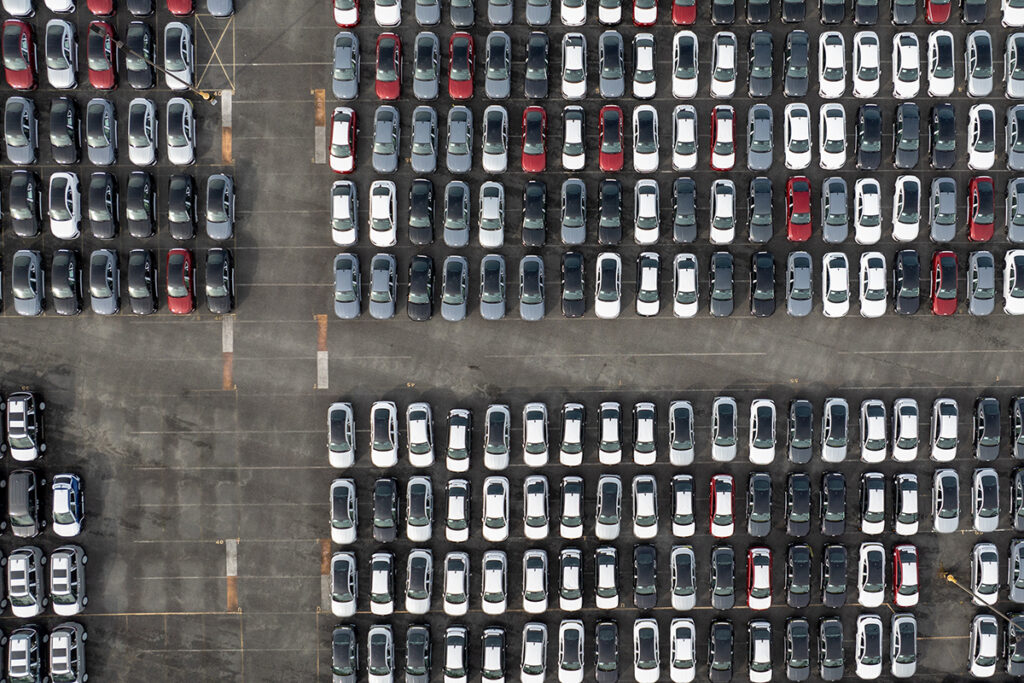

While overall trade showed a net loss, Japan maintained a sizable surplus in its trade relationship with the United States. The surplus with the U.S. reached 9 trillion yen ($63 billion), underscoring the strength of Japanese exports in key industries such as automobiles, machinery, and electronics. This surplus has placed Japan in the spotlight amid increasing scrutiny from U.S. policymakers, particularly those advocating for more protectionist trade measures.

The value of the yen, which has weakened considerably over the past two years, has made imports costlier for Japanese businesses while simultaneously boosting export competitiveness. However, this currency-driven advantage has not been sufficient to offset the trade gap caused by elevated energy prices and supply chain challenges.

Tensions Rise as Trump Revives Tariff Strategy

The deficit report comes at a time of renewed trade tensions between Japan and the United States. President Donald Trump recently announced a blanket 24% tariff on Japanese imports, a move that drew widespread concern both in Tokyo and among international markets. Although a 90-day suspension has been applied to parts of the tariff package following negotiations, the threat of a prolonged trade dispute looms large.

Existing tariffs already include a 10% base rate and additional duties of up to 25% on key sectors like automobiles, steel, aluminum, and auto parts. These measures are seen as part of Trump’s broader push to reduce U.S. trade imbalances, especially with nations that run significant surpluses with the United States.

Japanese Prime Minister Shigeru Ishiba has voiced apprehension that these tariffs could damage bilateral relations and discourage future Japanese investment in the U.S. market. Japan is one of the largest foreign investors in the United States, contributing to job creation and economic growth in sectors ranging from manufacturing to technology.

In an effort to de-escalate the situation, Japan is preparing to send its chief trade negotiator to Washington for high-level talks. The Japanese government remains committed to diplomatic solutions and has so far resisted calls for retaliatory tariffs, opting instead to emphasize shared economic interests and the importance of open markets.

Shift in Export Strategies as Regional Trade Strengthens

Despite the friction with the U.S., Japan recorded a monthly trade surplus in March of 544 billion yen ($4 billion), driven by a 4% rise in overall exports. While exports to the U.S. grew by 3%, shipments to China declined—reflecting both geopolitical tensions and a slowdown in Chinese demand.

Notably, exports to regional markets such as South Korea, Taiwan, and Hong Kong saw significant increases, indicating a shift in Japan’s trade strategy. Japanese firms are increasingly diversifying their customer base within Asia, a move designed to reduce dependence on Western markets and mitigate the risks associated with U.S. protectionism.

Economists suggest that Japan could also consider expanding its imports of U.S. agricultural products, including rice and soybeans, as part of a negotiated trade deal. This approach may help ease tensions while addressing domestic shortages in certain food categories caused by weather disruptions and supply constraints.

The trade ministry is currently reviewing options for targeted import reforms that balance strategic needs with broader economic policy goals. The objective is to protect national interests while remaining engaged in global trade frameworks.

Global Ripple Effects and Japan’s Economic Outlook

The Japan-U.S. tariff dispute is part of a broader trend of increasing global trade fragmentation. Central banks across the world are responding to these tensions by adjusting monetary policy. The European Central Bank, for example, has reduced interest rates for the seventh consecutive time, citing the negative effects of tariffs on regional manufacturing and investment.

In this volatile environment, Japan’s economic policymakers face difficult decisions. On one hand, the country must protect its domestic industries and ensure a stable supply of key goods. On the other hand, it must continue to advocate for rules-based trade and avoid escalation that could trigger retaliatory actions from other nations.

The Japanese government has reaffirmed its commitment to multilateral trade agreements, including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), as a counterbalance to unilateral tariffs.

As Japan prepares for a new round of international trade talks, its approach will be closely watched by allies and rivals alike. The outcome of its negotiations with the United States could set the tone for future economic diplomacy in a world where globalization faces renewed challenges.