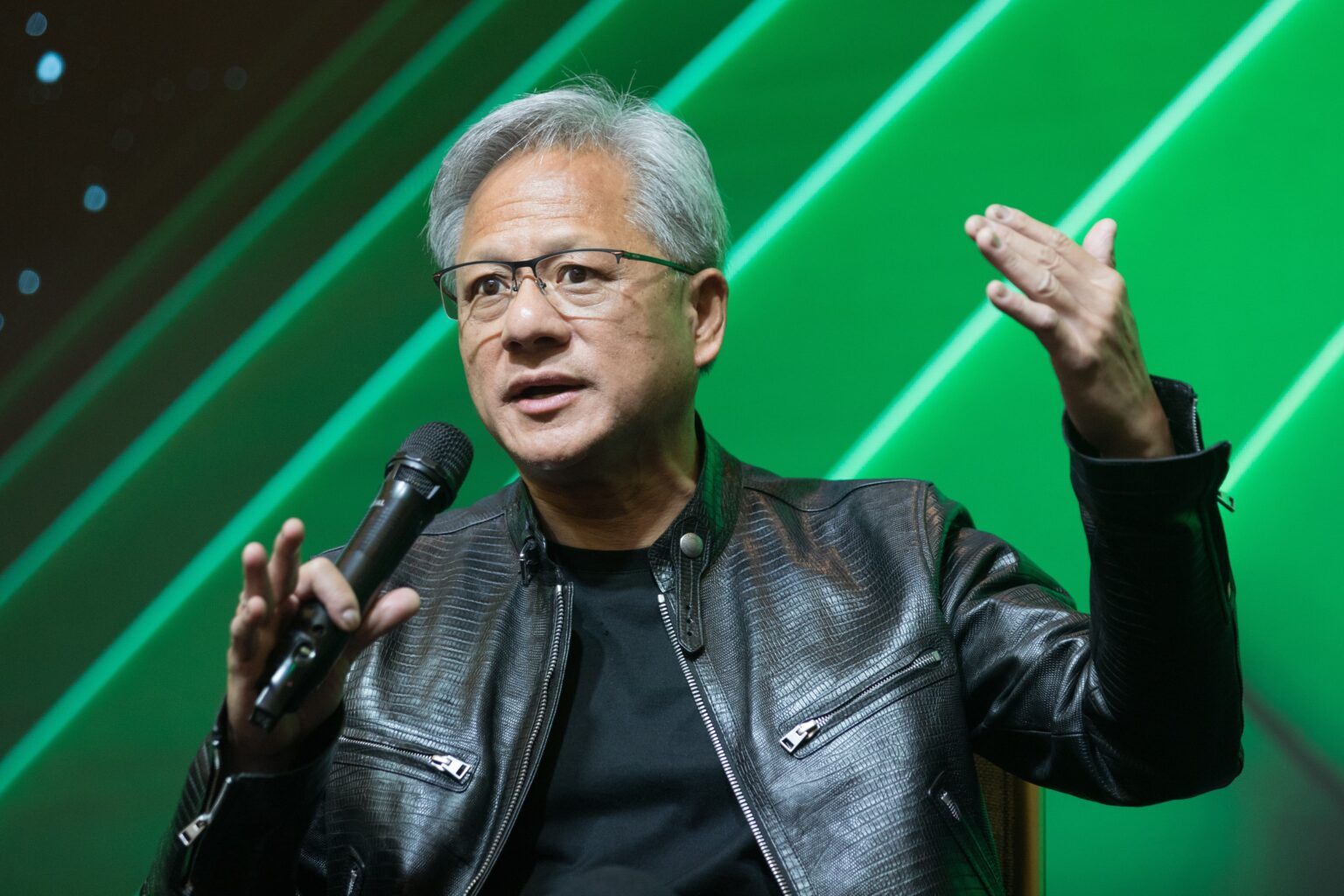

At the China International Supply Chain Expo in Beijing, Nvidia CEO Jensen Huang took a cautious stance when asked about the resumption of H20 chip exports to China. Speaking to reporters, Huang made it clear that the decision to lift restrictions on Nvidia’s high-performance AI chip was not a result of his lobbying, but the outcome of government-level negotiations between the United States and China.

“We can only influence them, inform them … and then beyond that is out of our control,” Huang stated. He emphasized that Nvidia offered technical context to the U.S. government, particularly about the H20 chip’s capabilities and its relevance to China’s AI sector, but ultimately, “the decision was entirely in the hands of the American and Chinese governments.”

The H20 chip had been at the center of U.S. export restrictions earlier this year, which had been motivated by concerns over its potential use in sensitive military or surveillance applications. The ban significantly affected Nvidia’s revenue in China, once one of its largest markets. However, Huang distanced himself from any narrative suggesting he played a personal role in reversing the restriction.

AI Chip Market Sees Renewed Momentum

Nvidia’s H20 chip is a scaled-down AI processor originally designed to comply with U.S. export laws. Its ban in April 2025 meant that Nvidia was temporarily locked out of one of its key markets. Analysts estimate that the company may have lost up to 5.5 billion US-Dollar in potential sales during the ban.

However, the situation changed rapidly after a broader agreement between Washington and Beijing allowed Nvidia to begin filing export licenses again, provided certain security standards were met. The easing of restrictions coincided with a bilateral deal over rare earth magnets, which are essential components in high-tech manufacturing, and likely influenced Washington’s softer stance.

Now that exports have resumed, Nvidia is gearing up to meet expected demand from Chinese tech companies like Alibaba and DeepSeek, both of which have shown interest in deploying the H20 chip for their generative AI models. Huang described the chip as highly capable in terms of memory bandwidth, and well-suited for China’s large-language model infrastructure.

The company is also aligning its production cycles to incoming orders. While it remains uncertain whether the lost revenue can be fully recovered, Nvidia executives are optimistic about a robust recovery in sales.

Launching New Chips, Expanding AI Horizons

During his visit, Huang also announced the launch of Nvidia’s new RTX Pro chip, tailored for industrial use in robotics and smart manufacturing. He called this development “the next wave in AI,” referring specifically to China’s growing demand for humanoid robots and automation technology.

China has been rapidly investing in AI-related infrastructure, and Nvidia sees an opportunity to supply the computing power needed to sustain those ambitions. The RTX Pro chip, which integrates advanced graphics and AI acceleration features, is expected to be a cornerstone of Nvidia’s strategy in Asia.

Huang praised China’s willingness to adopt frontier technologies, stating that the country’s advancements in robotics were “years ahead in some domains.” His comments suggested a carefully calibrated effort to maintain good relations with Chinese tech leaders, even as geopolitical tensions remain high.

Navigating Geopolitics and Regulatory Scrutiny

Huang’s visit to China came under scrutiny from U.S. lawmakers, who voiced concerns about Nvidia’s ongoing business relationships in the country. Senators Elizabeth Warren and Jim Banks had written a letter warning that Nvidia should avoid cooperating with Chinese firms connected to military or intelligence agencies.

In response, Huang acknowledged the concerns but reiterated that Nvidia’s operations adhere strictly to U.S. export regulations. He also argued that limiting access to American platforms would not stop China from advancing its own military AI technologies, which are increasingly being built on domestic chips and open-source software.

“The genie is out of the bottle,” Huang said, highlighting that AI innovation is global, and that China’s open-source models are pushing the field forward. He also suggested that U.S. leadership in AI would be better preserved through engagement, not isolation, particularly when it comes to commercial AI applications.

His remarks reflect the broader balancing act that many American tech companies face, expanding in global markets while staying within the bounds of national security policy.

Nvidia’s resumed sales in China may offer a temporary revenue boost, but the broader question of how U.S. firms engage with rival powers in strategic technologies remains unresolved. As demand for AI computing continues to grow, companies like Nvidia will likely remain at the center of this complex geopolitical chessboard.